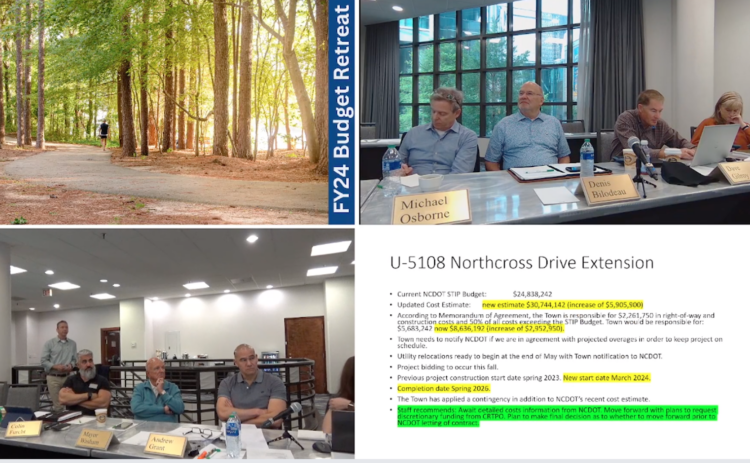

Budget discussions include spending on Northcross Drive extension, a key north-south connector

April 5. By Dave Yochum. While general fund expenditures would arguably fall—due to one-time ARPA funds that were placed into reserve accounts during FY23—chances of a revenue-neutral town budget in FY24 may be in doubt.

In fact, Town Manager Andrew Grant is recommending a budget that would be 2 cents above revenue neutral, or 18.3 cents per $100 of assessed valuation.

Revenue neutral, which builds in a revenue increase equal to the average of the last 4 years in Cornelius, would be 16.3 cents per $100.

Budget process

The FY24 budget is a work in progress, with hours of discussion ahead, negotiations around needs vs. desires and a real desire to keep a lid on property taxes. How much of an increase, based on spending in administration, parks, public works, roads and safety is what lies ahead during the next roughly 11 weeks. The new budget must be in place when the 2024 Fiscal Year begins July 1.

All this is taking place in the midst of an economy in flux.

Dave Gilroy

Grant could not be reached for comment, but veteran budget monitor and Commissioner Dave Gilroy said the town manager’s proposed budget would represent a 12.3 percent tax increase in local property taxes. “It would be the first time in Cornelius history for two consecutive tax increases, after 5 percent last year,” Gilroy said.

In concert with the county-wide revaluation, some increases will be higher, some lower.

A tax rate of 16.1 cents per $100 of valuation would be revenue neutral. The county has already said they cannot adopt a revenue neutral budget.

The proposed budget calls for total spending around $31 million. The $33 million in the current fiscal year includes roughly $4 million in reserve fund allocations for Smithville revitalization and other projects—money held in reserve to be spent over many years in the future.

“That’s not money that was spent last year, just accounted for in one bucket instead of another. It never left our bank account. So, it’s silly to say the town is going to spend less next year—$31 million vs $33 million. What matters is recurring personnel and operations which is always comparable from one year to the next,” Gilroy said.

Personnel costs

Personnel expenditures are on the rise, partly because of inflation and the need for more staff in a growing town, as well as the effort to get salaries here closer to market rates.

But Gilroy said the rate of local government spending is growing “super fast.”

“This year, our town manager is recommending a 16.5 percent increase in personnel expenditures. He proposes paying for this with a 12.3 percent tax increase. This follows a 5 percent tax increase last year and the highest tax increase since the 13 percent tax increase in 2020,” Gilroy said.

During the discussions Commissioner Denis Bilodeau said an increase of 2 cents above revenue neutral was too much. In fact, he advocated for revenue neutral—with the help of reserve funds.

Denis Bilodeau

“Manager Grant ‘s proposal addresses the quality of life issues most important to our citizens. I believe we can afford this plan without a tax increase and remain revenue neutral in this reval year,” Bilodeau said.

Must taxes go up?

The Town of Cornelius must publish a revenue neutral rate prior to setting the tax rate by June 30. It’s possible for your local tax bill to go down, if the rate falls enough to compensate for the higher increase in value. Of course, the opposite is true.

The overall property tax rate is driven by Mecklenburg County taxes, so property owners anxious to see what their tax bill will be next year will have to wait. All the fiscal back and forth among the town commissioners only impacts only part of the rate.

Sources in Mecklenburg County say the county’s new tax rate is expected to be higher than revenue neutral. It appears to be a toss-up in Cornelius with sentiments on both sides of the equation on the Town Board.