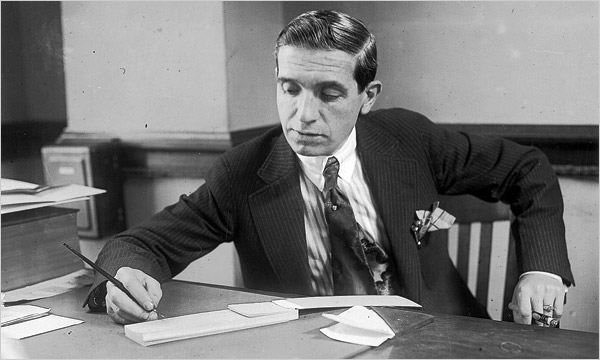

The original Ponzi. Photo: Wikipedia

March 6. Anyone can say anything. What he or she does is another thing.

Here’s what Andrew “Diamond Drew” Lovett said in 2012: “I am proud that Safari Minerals has been able to achieve all it has thus far while following a strict code of ethical business practices and sound financial discipline.”

Here’s what he said in federal court this week:

Guilty.

SOURCE: LINKEDIN

According to plea documents and a plea hearing this week in Utah, Lovett ran a precious metals investment Ponzi scheme, obtaining nearly $850,000 from more than 30 investors. The Feds say he induced victims to invest their money, and falsely told them that their money would be used to grow Safari and to develop various purported mining projects.

Local offices

Safari had offices in Mooresville and Catawba NC. Acting US Attorney William T. Stetzer said Lovett, 59, lived in Cornelius at one time. Stetzer did not identify victims of the Ponzi scheme.

What’s a Ponzi scheme?

A Ponzi scheme, which leads victims to believe that profits are coming from legitimate business activity, is a form of fraud that pays profits to earlier investors with funds from more recent investors.

Investors on Safari

According to court records, Lovett described Safari to his investors as “an emerging junior exploration and mining company” that focused on acquiring and developing properties in Nevada which “contains an abundance of … Gold, Silver, Platinum Group Metals and Rare Earth Elements….”

Lovett also misled investors by touting his experience as a seasoned businessman with a wealth of experience in the mining industry. But Lovett admitted he lied to investors about the progress and viability of Safari and failed to disclose to investors his diversion of several hundred thousand dollars from Safari for his own personal use.

Guilty plea

Lovett pleaded guilty to “transactional money laundering,” a means of hiding the sources of cash.

Lovett has been released on bond. The securities fraud charge carries a maximum penalty of 20 years in prison and a $1 million fine. The transactional money laundering charge carries a maximum prison term of 10 years and a $250,000 fine.

Stetzer thanked IRS-CI, the FBI and the USPIS for their work on the case. Assistant United States Attorneys Daniel Ryan and Caryn Finley, of the U.S. Attorney’s Office in Charlotte, are prosecuting the case.