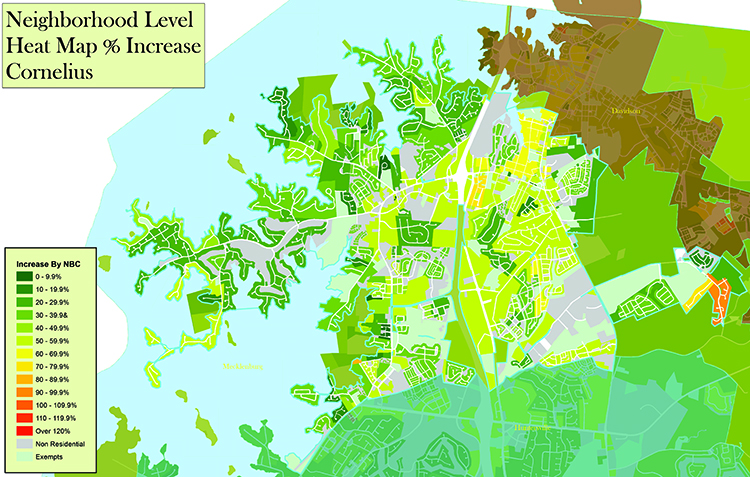

Feb. 12. By Dave Yochum. A “heat map” of changes in Cornelius property values shows stronger gains on the east side of town, more so than west of I-77. The tax burden can shift more to faster-appreciating neighborhoods in a one-size-fits-all tax rate scenario.

It means that tax values are aligning more so with soaring real estate values—regardless of anyone’s ability to pay the tax man.

Mecklenburg County officials say residential properties rose an average of 44 percent since the 2011 reval. Commercial properties rose an average of 77 percent, according to Revaluation Notices sent out in January by the Mecklenburg County Tax Assessor.

Some close-in neighborhoods seem to have had the strongest gains, while values in some traditional suburban neighborhoods have risen at a lower rate.

The overall median sales price—not the valuation—around Charlotte increased 5.8 percent to $238,000 during 2018 alone. Single-family home prices were up 6.0 percent compared to last year, and Condo-Townhome home prices were up 9.7 percent.

There are no solid numbers yet. Tax rates for the upcoming fiscal year won’t be finalized until June, when the current year ends. Municipal valuation estimates aren’t expected before the end of February to indicate how much the total value has changed in each town, which would provide an estimate of what’s called “revenue neutral.”

Local governments are required to disclose what a revenue neutral tax rate would be, but they are not required to recommend, nor is the Town Board required to adopt a revenue neutral rate.

Revenue neutral actually means that the town, in total, would receive the same amount of property tax from one year to the next.

If a Town adopts a revenue neutral tax rate, individuals whose value increases less than average will pay less property tax.

Individual taxpayers whose property value increases more than the average will pay more. But the amount of revenue the Town receives would remain the same under a “revenue neutral” taxation plan.

Revenue neutral is from the town’s perspective, not each property owner.

NAAS

Cornelius Town Commissioner Kurt Naas said using a single tax rate for an entire county based on a county-wide reval is the equivalent of a blunt instrument.

“The system we have in NC means the tax burden shifts to appreciating neighborhoods. It’s unfortunate, but that is our current reality,” Naas said.

Smithville, the historically black community just west of I-77 on either side of Catawba Avenue, appears to have had particularly strong increases in property values. Naas says that’s a problem.

“The issue with our system is that people in an appreciating neighborhood like Smithville can literally be taxed out of their homes. That’s just wrong,” he said.

“The NC homestead exemption should be expanded to include a limit on tax increases for multi-generational and long-term homeowners,” Naas said.

The tax rate and the individual burden hinges on the town’s spending plan and budget. New amenities—sidewalks, for example, or buried utility lines on West Catawba, or police raises—are costs that can be added in or subtracted out.

It will all play out as budget talks get under way at the town board retreat in March.

“The net tax increase (if any) will depend on the overall budget that will be adopted in June, and is the topic for discussion at this year’s budget retreat,” Naas said.

Another town commissioner called the reval process is “arduous at best.”

BILODEAU

“I would like to see less time elapse between value reviews to help soften the shock of steep changes,” said Commissioner Denis Bilodeau.

“No one wants higher taxes however feedback I am receiving indicates the new values are more accurate and easier to review than the last go-round in 2011,” he said.