June 11. Business Today is reporting that the old Augustalee property is under contract. The sale price and buyer likely won’t be disclosed until after a 150-day due diligence period is completed.

Executives at Concord-based ACN purchased the 110-acre Augustalee property for $7.3 million in 2012 after Fifth Third Bank took it back from Bromont Investments, the original developer a decade ago.

The property had been on the market at $22 million, local commercial real estate brokers said. Sources close to the project said the new price-tag is $20 million.

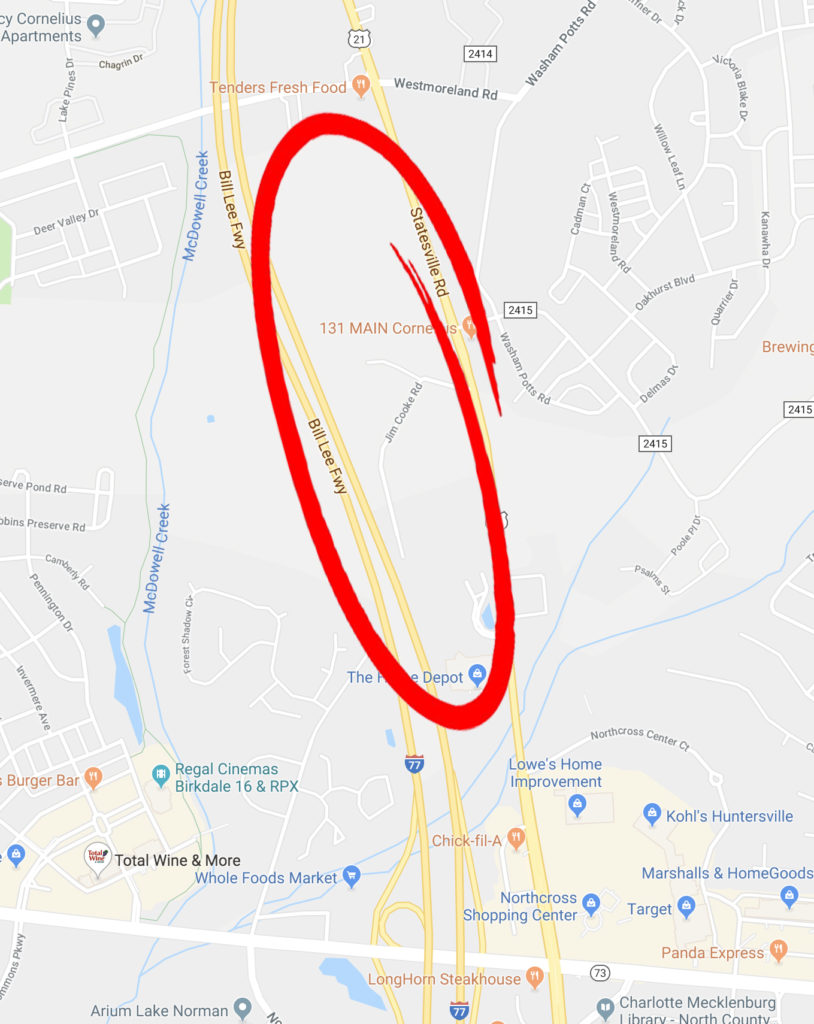

AUGUSTALEE IS LOCATED OFF OF I-77 BETWEEN WESTMORELAND AND 73

Bromont, a Scottsdale, Ariz., developer, set Cornelius on its collective ear when it paid $34 million for property that was actively farmed until about 2006.

Plans back in 2006-2007 called for a 1.4 million-square-foot mixed-use project dubbed The Village at Lake Norman in Cornelius. It would have competed with Birkdale to the west on Hwy. 73, and LangTree in Mooresville, which had equally ambitious plans before the real estate market fell apart.

The Village morphed into Augustalee, and the project became the talk of the economic development world. Walt Rector, a noted equestrian, had plans for a $40 million exit off Interstate 77. Dubbed Exit 27, it would have relied on government grants generated by the increased tax revenue the project could generate.

Augustalee is still bucolic property, with coveted exposure on I-77 between Exit 25 and Exit 28.

While a new Exit 27 is not part of NCDOT planning, the Town of Cornelius is working with Kimley-Horn design consultants on the development of an Interchange Access Report—necessary to obtain approval from Federal Highway Administration and NCDOT for an overpass.

“We are about halfway through the process to reach the final report,” said Andrew Grant, Cornelius town manager.

A new Exit 27 interchange is considered essential to “unlocking the commercial development potential of the study area,” according to a 2015 Lake Norman Economic Development study drafted by the Urban Land Institute.

The study went on to say that a traditional single-point urban interchange at Westmoreland Road would “not serve the best interests of all parties involved,” suggesting that a more complex “Square” interchange or “Counterchange” could create a signature gateway to the community.

Cornelius experienced tremendous growth between 2000 and 2010, more than doubling in population from 11,969 to 24,866, but far less non-residential growth over the years, according to the ULI report.

Fifth Third Bank was the senior lender on the proposed $155 million, mixed-used development; the BUILD Fund was the secondary lender until foreclosing on the original developers, Cornelius Bromont and Bromont Investments, in August of 2009.

At a foreclosure sale, the BUILD Fund was the sole bidder for Augustalee, offering $2.5 million. The fund had already advanced the development $19 million.